Addition Financial is growing

to better serve you!

We’re planning to merge Envision CU into Addition Financial in October 2025

Two Credit Unions with a Shared History and Vision

As previously announced in December 2024, Addition Financial is pursuing the opportunity to merge Envision Credit Union into our organization, whereby Addition Financial would be the surviving credit union. If the merger opportunity is approved, the merged Envision Credit Union membership would benefit from access to additional branches, products and services, and banking resources. This strategic merger will support our mission of being a trusted partner that puts the financial well-being of our members, team members and communities at the heart of everything we do.

I’m excited to share that the proposed merger has received regulatory approval from the National Credit Union Administration, the Florida Office of Financial Regulation and the Georgia Department of Banking and Finance. The members of Envision Credit Union will vote on September 12, 2025, on the proposed merger. If approved, we expect the merger to take effect on October 1, 2025. At that time, Addition Financial will hold nearly $4 billion in assets and serve more than 248,000 members across 38 branches in two states.

With this merger I truly believe that we will be adding strength and capability to your credit union, building a brighter tomorrow for our membership and helping our local communities thrive. It is an exciting time, and I thank you for being a valued member of Addition Financial.

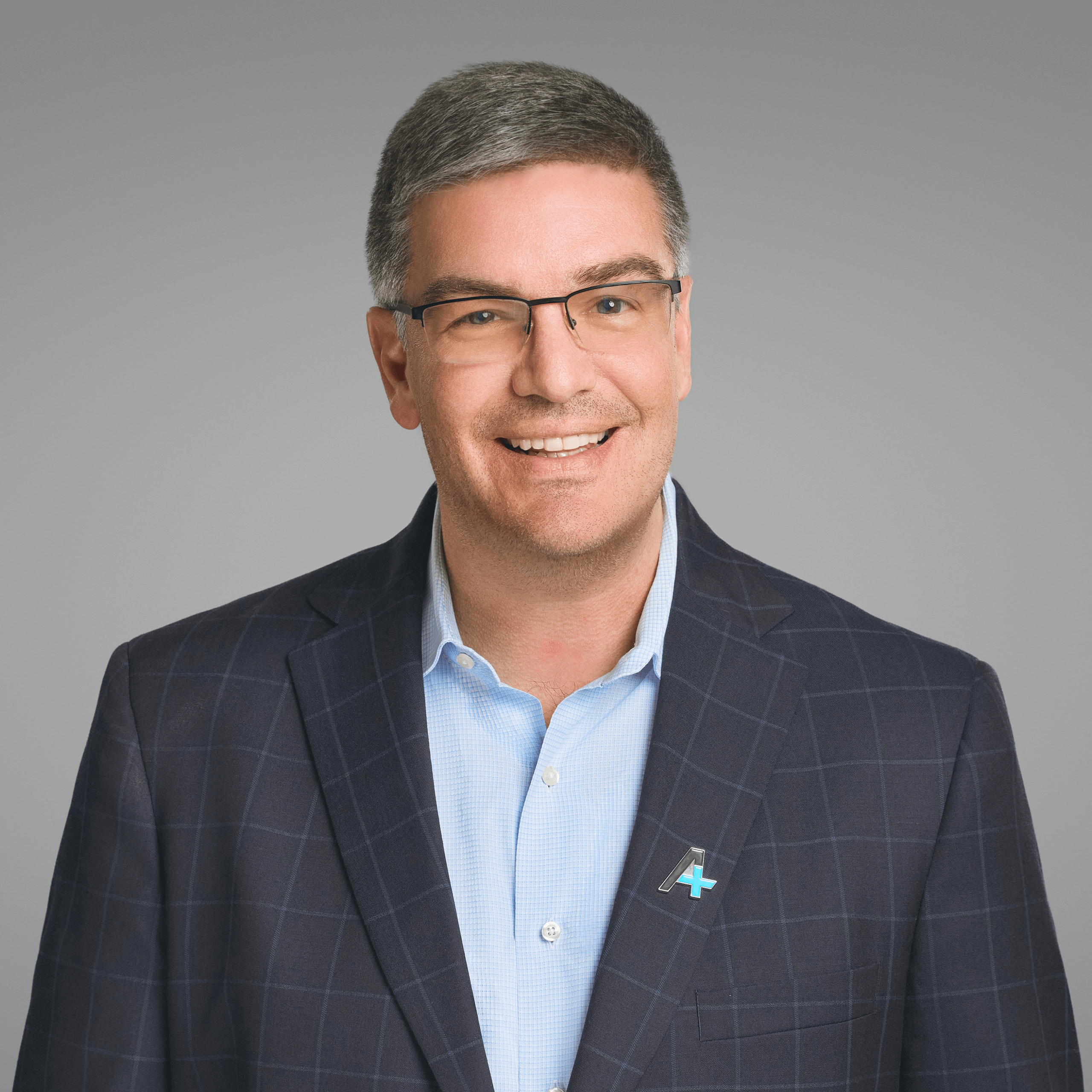

Kevin S. Miller

Thank you,

Kevin S. Miller

President/CEO, Addition Financial

Who is Envision CU?

We share a similar history and philosophy with Envision CU. They were originally founded in 1954 as a financial cooperative serving public educators in Leon County, Florida. Headquartered in Tallahassee, Envision currently serves over 63,000 members, across 19 counties in Florida and Georgia. I am pleased to say that all the employees of Envision CU, who will join the Addition Financial family, are just as passionate as we are about delivering exceptional member service and investing in the financial well-being of community residents.

What Will Be the Benefits for Addition Financial Members?

- Through this merger, we’ll extend our branch service territory with locations in North Florida and South Georgia.

- With our combined strength and expertise, we will be able to expand the scope and reach of our financial education programs benefiting both our membership and service communities.

- We will expand our philanthropic capability through joined scholarship and community giving programs designed to make a difference in the lives of local youth and support organizations.

What Happens Next?

As an Addition Financial member, you will continue to receive the same best-in-class banking experience that you have come to expect and deserve. In fact, for the second straight year, Newsweek has recognized Addition Financial as one of America’s Best Regional Credit Unions.

Addition Financial Credit Union and Envision Credit Union Announce Intent to Merge

LAKE MARY and TALLAHASSEE, Fla (Tuesday, December 17, 2024) – Addition Financial Credit Union and Envision Credit Union announced their plans to merge two award-winning institutions and expand service to members from Central Florida, North Florida, and South Georgia.

Under the terms of the agreement, which is subject to approval from the National Credit Union Administration (NCUA) and a membership vote, the combined credit union will continue to operate as Addition Financial Credit Union under the leadership of current President and CEO, Kevin Miller. Once the merger is complete, the credit union will hold nearly $4 billion in assets and serve more than 248,000 members across 38 branches in two states.

Founded in 1937 and 1954 respectively, Addition Financial, based in Lake Mary, Florida and Envision, based in Tallahassee, share similar histories, philosophies, and values. Both credit unions were created by small groups of educators who wanted better financial options than what banks were providing. In the intervening decades, the organizations have opened and grown membership in their broader communities.

This strategic alliance will allow the unified credit union to expand its services and product offerings to members, as well as optimize operational efficiencies, while continuing to provide the unparalleled level of member service both organizations are known for.

“This merger will significantly increase the ability of Addition Financial to serve more members, and support both communities,” said Kevin Miller, President and CEO of Addition Financial Credit Union. “By joining forces with Envision Credit Union and the people-first culture they have cultivated for 70 years, we can provide even greater value to our collective members and team members and continue our shared mission of supporting our communities.”

Darryl Worrell, President and CEO of Envision Credit Union added, “In bringing our teams together, we will draw the best from both credit unions to build on our legacies of service and honor the strong commitments to our communities. This merger enables us to provide more access to services, broaden offerings of innovative products, and deliver personalized support to every member and future member.”

Both boards of directors and leadership teams unanimously support the merger, which the credit unions anticipate will be finalized before the end of 2025, with system integrations extending into 2026. There will be no immediate changes as the merger process is ongoing. While Addition Financial and Envision will work in concert, the credit unions will remain two separate entities until the membership vote and system and process integration are complete.

###

About Addition Financial Credit Union:

Addition Financial Credit Union is a trusted banking and financial education partner that members of the Central Florida community rely on to help them along their financial journey. Founded in 1937, Addition Financial is a not-for-profit financial cooperative headquartered in Lake Mary, Florida with assets approaching $3 billion. As a member-owned credit union, Addition Financial puts the financial well-being of its more than 185,000 members at the heart of everything it does. With 26 full-service branches, 11 student-run high school branches, and financial products designed to provide better saving and loan rates and lower fees, Addition Financial is constantly growing and evolving to meet the needs of its members. Addition Financial is the Official Financial Institution of the UCF Knights and owns the naming rights of the Addition Financial Arena on the University of Central Florida campus. Addition Financial was named as one of the “Best Credit Unions for 2024” by Newsweek and one of the “Best-In-State Credit Unions for 2024” by Forbes. For more information, visit AdditionFi.com.

Envision Credit Union:

Founded in 1954 by Leon County educators, Envision Credit Union is a not-for-profit financial institution focused on providing personalized products and services of exceptional value to members at the lowest possible cost. Today, Envision serves more than 63,000 members across 19 counties in Florida and Georgia. In addition to the credit union’s unparalleled support of the local education community, it has been recognized by Florida Trend Magazine as a Best Place to Work for the past 2 years and was recently honored with the inaugural Legacy Partner Award by Second Harvest of the Big Bend. With over $880 million in current assets, it maintains a strong focus on giving back to education-based initiatives and upholding the credit union philosophy of people helping people. For more information, please visit EnvisionCU.com.

Video Announcement with Kevin Miller & Darryl Worrell

Kevin Miller, President and CEO of Addition Financial Credit Union, and Darryl Worrell, President and CEO of Envision Credit Union, announce plans to merge Envision Credit Union into Addition Financial Credit Union. Learn more about this exciting announcement.

Credit Union Merger Match Game with Kevin Miller & Darryl Worrell

See just how perfectly aligned Addition Financial and Envision are with the shared values of our two organizations and the bright future this merger represents.