Fixed-Rate Mortgage

Purchase a home or refinance a home you already own and love with our most popular, low-risk home loan option.

Predictability You Can Count On

Owning a home can come with a few surprises, but your monthly mortgage payment amount doesn’t have to be one of them. With principal and interest payments that stay the same for the life of your loan, a Fixed-Rate Mortgage takes the guesswork out of monthly budgeting. Plus, Addition Financial’s low fixed interest rates and flexible repayment term options make it easy to fit home ownership into your plans for the future.

Your perfect place is waiting!

If you’re thinking about upgrading, downsizing, relocating or refinancing, we’re here to help. Addition Financial’s Fixed-Rate Mortgages offer competitive rates, flexible terms and predictable monthly payments. Our local home financing experts will guide you through the mortgage process step by step and answer all of your questions to make your home purchase or refinance as smooth as possible.

- Conventional fixed-rate fully amortized loan

- Terms of 10, 15, 20, and 30 years available

- Minimum loan amount $25,000; maximum loan amount varies

- Up to 95% financing available1

- Points can be purchased to reduce the interest rate. We offer options of 0, 1%, and 2%.

- No pre-payment penalties

What to expect after you apply:

We want you to feel prepared as you navigate this application process. Download this Checklist to learn about what you'll need to have on-hand once you've hit "submit".

It's time to call the movers!

Whether you’re buying your first home, or you’ve done this before, Addition Financial offers a variety of mortgage options to suit your needs plus one-on-one advice to help you reach your goals.

- Review eligibility

Anyone who lives, works, worships, attends school or vocational training, or is an alum of any college, university, or educational institution located in one of our select counties may join.

- Complete loan application

When you’re ready, complete the online application or visit your branch to apply in person.

- Get your loan

Move into your new home.

1Only applies to purchase transaction and no cash out refinances.

Mortgage Rates

15 Year Fixed Rate

As low as

20 Year Fixed Rate

As low as

30 Year Fixed Rate

As low as

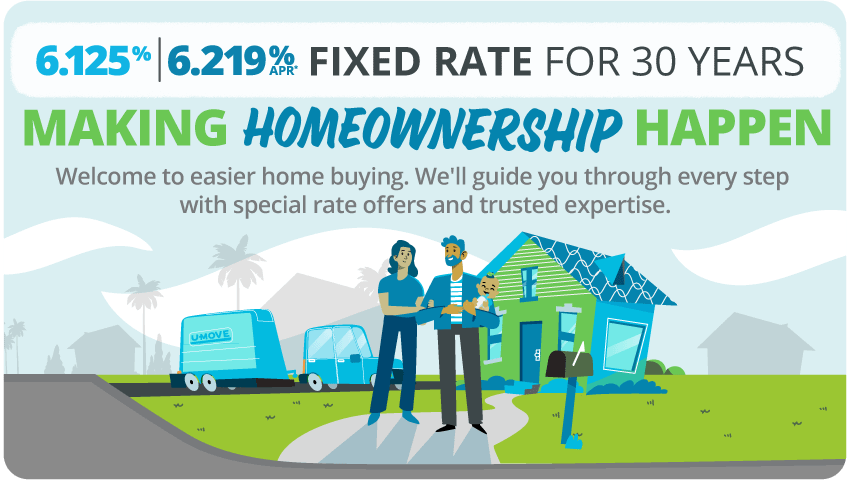

Special Offer

Rolling out our best rates for you.Welcome to a better way to buy a home. At Addition Financial, we make homeownership happen with 6.125% interest rate and 6.219% APR fixed rate for 30 years*.

Calculate Your Mortgage

Take the guesswork out of homebuying! Use our easy-to-use mortgage calculator to estimate your monthly payments and find the right loan for your budget. Start planning today!

Related Articles

Adjustable- vs. Fixed-Rate Mortgage: What's the Difference?

To help you understand your choices between an adjustable-rate mortgage vs. a fixed-rate mortgage, we’ve created this guide to explain the differences.

5 Tips on Saving for a Home & How Much You Should Save

We asked some financial experts for their advice for saving up to buy a home and here are five tips they shared with us.

Money + Love Part V: Family Loans & Aging Parents

This episode covers the risks and rewards of lending money to a family member, how to talk to your parents about their long-term care plan and how to help your child navigate student loans.