Become a Member

Addition Financial helps you make every moment and every penny count. From simple everyday money management to planning, saving and financing for your long-term goals, we’ve got the tools and know-how that give you the power to accomplish your goals.

How Do I Join?

Becoming a member is simple. You don’t have to pass any tests, learn any secret handshakes or survive any hazing rituals. All you need is $5 to open a Share Savings account and $10 for a one-time-only lifetime membership fee. If you’re a student, we’ll even waive the fee and spot you the five bucks. What’s up with having to open a savings account even if you’re just here for a loan? It’s because we’re a financial cooperative – that savings account is what makes you a part owner of Addition Financial.

Who Can Join?

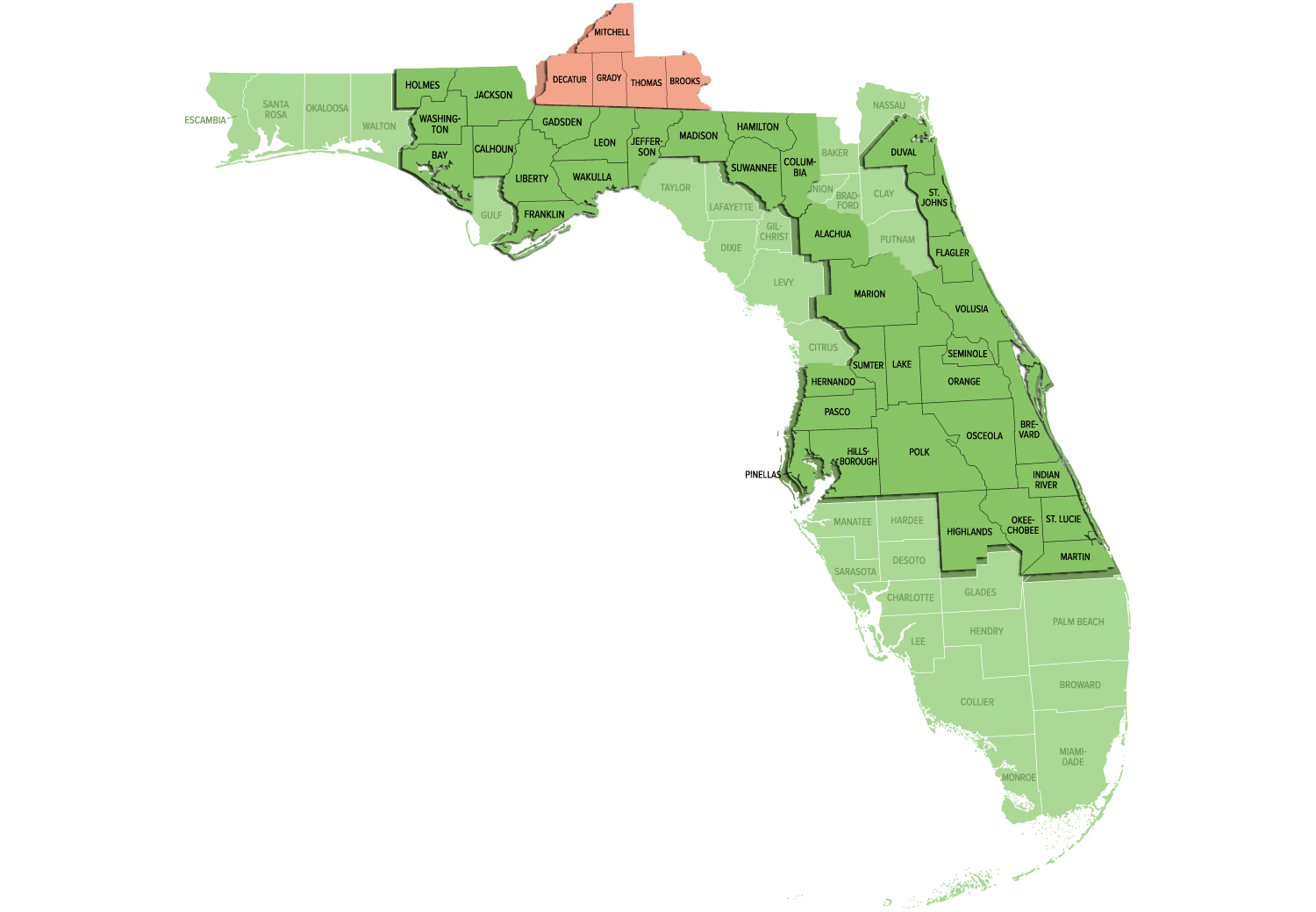

Addition Financial’s field of membership is based on a community charter. Anyone who lives, works, worships, attends school or vocational training, or is an alum of any college, university, or educational institution located in these Florida and Georgia counties.

Alachua | Bay | Brevard | Calhoun |

Clay | Columbia | Duval | Flagler |

Franklin | Gadsden | Hamilton | Hernando |

Highlands | Hillsborough | Holmes | Indian River |

Jackson | Jefferson | Lake | Leon |

Liberty | Madison | Manatee | Marion |

Martin | Okaloosa | Okeechobee | Orange |

Osceola | Pasco | Pinellas | Polk |

Putman | Sarasota | Seminole | St. Lucie |

St. Johns | Sumter | Suwannee | Volusia |

Wakulla | Walton | Washington |

|

Brooks | Decatur | Grady |

Mitchell | Thomas |

|

Why Join?

Because smart banking = better living

As a member-owned, not-for-profit financial cooperative, we’re here because of you. Our profits don’t go toward lining some investor’s pocket, they go toward making your life better with more dividends, fewer fees and powerful tool

What You Will Need:

- Unexpired government issued ID (i.e., driver's license, state ID, passport, etc.)

- If the address on your ID does not match your current residence: current utility bill, vehicle registration, lease or rental agreement, mortgage documents, voters registration card, bank statements, pay stub, or official mail (i.e., IRS documents, credit card statements, home or auto insurance, or court documents.)

- Complete physical address

- E-mail address

- Social Security Number

- Eligibility: anyone who lives, works, worships, attends school or vocational training, or is an alum of any college, university, or educational institution located in a qualifying county

- Payment ready for a $10 membership fee and $5 minimum balance in share savings

Addition Financial Credit Union does not exclude, deny benefits to, or otherwise discriminate against any person on the grounds of race, color, national origin, disability, age, sex, gender identity, religion, or creed in employment or receipt of the services and benefits under any of its programs and activities. It provides equal access to its employees, members, and potential members.

Any person who believes he or she has been the subject of any unlawful discrimination practice may file a written complaint to the following person, who has been designated to handle discrimination inquires:

This notice is in accordance with the provisions of:

- Title VI of the Civil Rights Act of 1964 (Title VI), 42 U.S.C. §§ 2000D –2000D7 – Prohibits discrimination based on race, color, and national origin.

- Title VII of the Civil Rights Act of 1964 (Title VII), 42 U.S.C. §§2000E – 2000E17 – Prohibits discrimination based on sexual orientation and gender identity.

- Age Discrimination Act of 1975, 42 U.S.C. §6101-6107 ET SEQ. – Prohibits discrimination based on age.

- Title IX of the Education Amendments Act of 1972, 20 U.S.C. §§1681- 1688 – Prohibits discrimination based on sex in educational programs.

- Section 504 of the Rehabilitation Act of 1973, 29 U.S.C. §794 – Prohibits discrimination based on disability.

- Fair Housing Act, Title VIII of the Civil Rights Act of 1968. 42 U.S.C. §§ 3601 ET SEQ. – Prohibits discrimination based on race, color, national origin, religion, sex, familial status (having one or more children under 18) and disability.

NOTICE OF NON-DISCRIMINATION – CDFI FUND

Upon request, a Spanish translation of the Nondiscrimination and Civil Rights Information web page is available Non-Discrimination Statement and Civil Rights Information | Community Development Financial Institutions Fund (cdfifund.gov). Para solicitar esta información en español, envíe una solicitud a través de cdfihelp@cdfi.treas.gov. To request this information in Spanish, please submit a request to cdfihelp@cdfi.treas.gov.