Fast Track Refinance Mortgage

Light at the end of the tunnel.

It probably feels like you’ve been making mortgage payments forever. Put the end in sight by refinancing to a loan that offers a low fixed rate and a 5 or 10 year payoff.

Own your home free and clear.

When you bought your home, your mortgage made sense for your needs at the time. But life doesn’t stand still and you don’t want to either. Retire without a mortgage or pay off your mortgage early by refinancing with Addition Financial. Our Fast Track Mortgage offers low rates, low closing costs and quick closing to get you on the way to owning your home outright in the next 5 to 10 years.

Short Commitment + Long-Term Savings

Conventional mortgages can feel like a life sentence, not to mention how much interest you’ll end up paying over the course of 30 years. Want to save money in the long run and enjoy life without the financial responsibility of a mortgage? Pay off your mortgage in 5 or 10 years at a low fixed rate by refinancing to an Addition Financial Fast Track Mortgage.

- 5 and 10-year terms available

- Minimum loan amount $10,000; maximum loan amount $500,000

- Financing available for up to 80% loan to value

- Only primary residence; no condos or investment properties

Put the “own” in homeowner.

Reach your goal of owning your home with no strings attached sooner than you had originally planned. Addition Financial’s mortgage experts will help you figure out if a faster payoff is the best thing for your budget.

- Review eligibility

Anyone who lives, works, worships, attends school or vocational training, or is an alum of any college, university, or educational institution located in one of our select counties may join.

- Complete loan application

When you’re ready, complete the online application or visit your branch to apply in person.

- Make sure you have everything you need.

Start the countdown to your last mortgage payment.

What to expect after you apply:

We want you to feel prepared as you navigate this application process. Download this checklist to learn about what you'll need to have on-hand once you've hit "submit".

*Consult your tax adviser for details.

Mortgage Rates

5 Year Fast Track Refinance Mortgage

As low as

10 Year Fast Track Refinance Mortgage

As low as

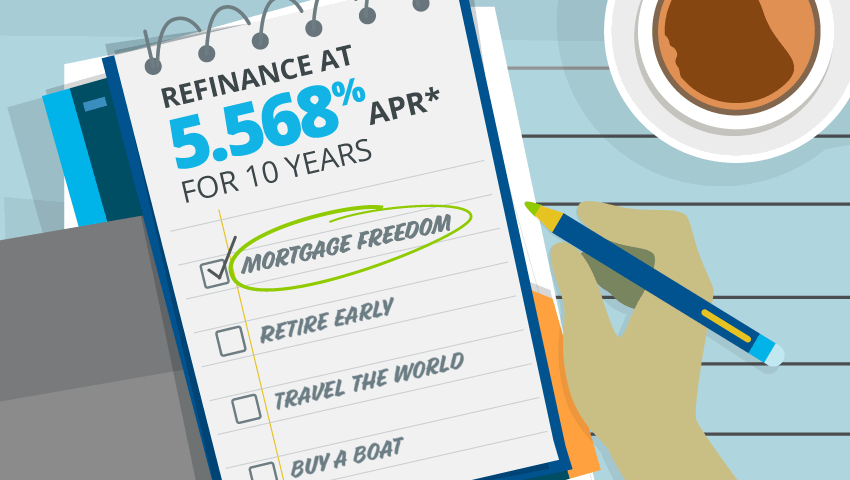

Special Offer

Because some goals can't wait 30 years.Fast track your future with a shorter path to mortgage freedom. Addition Financial helps you reach your goals sooner with 5.125% interest rate and 5.568% APR* fixed rate for 10 years*.

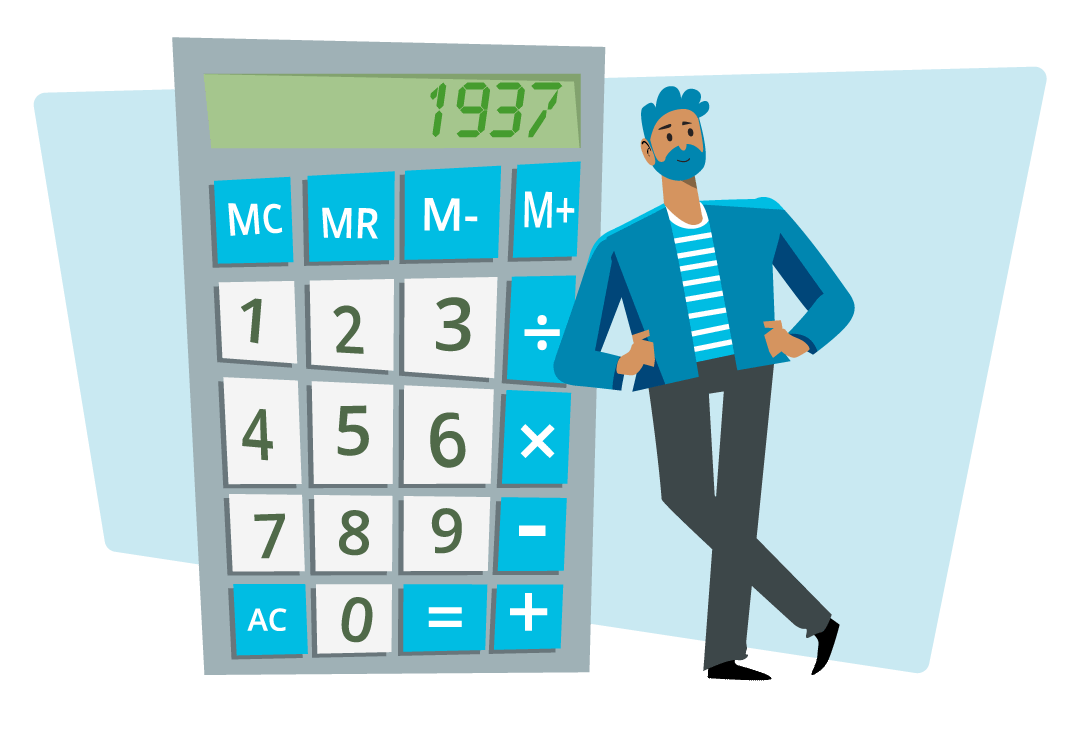

Calculate Your Mortgage

Make informed decisions about your home financing with our suite of mortgage calculators. Whether you're a first-time homebuyer or exploring HELOC options, our calculators help you estimate costs, and plan confidently for the future. Take the guesswork out of home financing and start planning your next move today!

Related Articles

5 Tips on Saving for a Home & How Much You Should Save

We asked some financial experts for their advice for saving up to buy a home and here are five tips they shared with us.

How to Save Money for a House Down Payment While Renting

For many young people, it’s a priority to save money to buy a house, so they can stop renting. Saving isn’t easy, but here are some things you can do to help you save money for a house.

Average Expenses & Costs of Owning a Home for 2023

One of the things that a lot of homebuyers have in common is a fundamental misunderstanding of the costs of owning a home.